How to Claim Lost Wages from a Car Accident in California

You’re hurt. You’re missing work. And the bills don’t care that some distracted driver ran a red light and turned your life upside down.

This is where most people panic. The rent is due, your car is totaled, and your employer is being weirdly vague about when they’ll “hold your position.” Meanwhile, the at-fault driver’s insurance company is already trying to lowball you before you even know what your claim is worth.

California law says you’re entitled to full compensation for all detriment proximately caused by someone else’s negligence. That’s Civil Code § 3333. “All detriment” includes every paycheck you’ve missed and, in many cases, the paychecks you’ll miss in the future. California is a fault state with no personal injury protection insurance, so your recovery comes through the at-fault driver’s liability coverage or a lawsuit.

Key Takeaways

Priority

California doesn’t require a physical injury to recover lost wages. If PTSD, driving anxiety, or a totaled car kept you from working, you may still have a claim under Civil Code § 1714.

You have two years from the accident date to file a personal injury lawsuit in California — but only six months if a government vehicle was involved.

→ Miss the government claim deadline and your case is gone forever

Self-employed and gig workers can absolutely claim lost income. It’s harder to prove without pay stubs, but California courts allow it with the right documentation.

Lost wages received as part of a physical injury settlement are tax-free under federal law — and California conforms. Many law firm websites get this wrong.

As of January 1, 2025, California’s minimum auto insurance limits doubled under SB 1107 to $30,000 per person and $60,000 per accident — meaning more coverage available for your claim.

Can You Get Lost Wages from a Car Accident Without a Physical Injury?

Yes. And this surprises a lot of people.

California Civil Code § 1714 says everyone has a duty to exercise ordinary care to prevent injury to others. Notice the word it uses. “Injury.” Not “physical injury.” That distinction matters a lot.

The California Supreme Court cleared this up back in 1980 with Molien v. Kaiser Foundation Hospitals. The court held that a direct victim of negligence can recover damages for emotional distress without any physical injury at all. The reasoning was simple and hard to argue with: emotional injury can be every bit as severe and debilitating as physical harm.

What Qualifies as a Non-Injury Lost Wages Claim?

A few common scenarios. You develop PTSD or severe driving anxiety after the accident and can’t get behind the wheel to commute. Your car is totaled, you live 30 miles from work, and there’s no reasonable alternative transportation. You’re spending hours every week dealing with insurance adjusters, sitting in repair shops, or attending depositions.

All of these can form the basis of a lost wages claim. The critical piece is causation. You need a clear line from the defendant’s negligence to your missed paychecks. For emotional distress claims, that typically means a formal diagnosis from a mental health professional. A psychiatrist documenting acute stress disorder or PTSD carries real weight.

One more thing worth knowing. There’s no cap on emotional distress damages in California car accident cases. The MICRA cap only applies to medical malpractice. Car accidents are a different ballgame entirely.

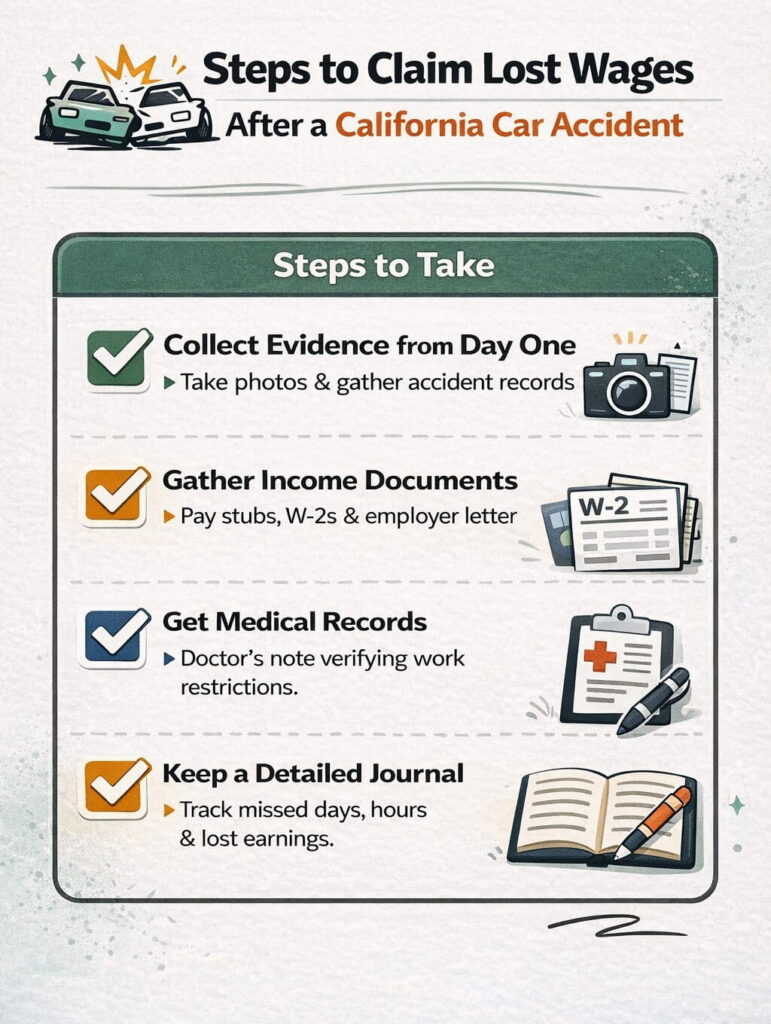

What Steps Do You Need to Take to Claim Lost Wages After a California Car Accident?

- Start collecting evidence from day one: Seriously, day one. The more organized your records are, the harder it is for the insurance company to chip away at your claim.

- Collect your pay stubs: You’ll want three to six months of pay stubs plus two years of W-2s or 1099s. Get your employer to write a verification letter that includes your job title, hire date, regular hours, pay rate, overtime rate, the exact days you missed, and any bonuses or commissions you would have earned during that period. If your employer won’t write one voluntarily, your attorney can request it formally.

- Medical records: You need documentation from your doctor specifically stating that your injuries prevented you from working, with a prognosis and return-to-work timeline. Vague notes don’t cut it. “Patient should rest” is weak. “Patient is unable to perform occupational duties due to lumbar disc herniation and is expected to remain out of work for approximately eight weeks” is strong.

- Keep a daily journal: Track every missed day, every partial day for a doctor’s appointment or physical therapy session, every hour spent dealing with accident-related tasks. Include missed overtime opportunities. Include commissions you would have earned based on your track record. And here’s something most people don’t realize: if you used sick days or vacation time to cover your absence, you can still recover those. The collateral source rule established in Helfend v. Southern California Rapid Transit says payments from independent sources don’t reduce what the at-fault party owes you.

What’s the Filing Deadline?

Two years from the date of injury. That’s CCP § 335.1. Sounds like plenty of time until it isn’t.

But if a government vehicle caused your accident, a city bus, a county truck, or a state vehicle, you only have six months to file an administrative claim under Government Code § 911.2. Miss that window, and your claim is likely dead. This catches people off guard constantly.

One important note: don’t settle before you’ve reached Maximum Medical Improvement. That’s the point where your doctor says you’re as healed as you’re going to get. Settling early almost always means leaving money on the table because you don’t yet know the full extent of your losses.

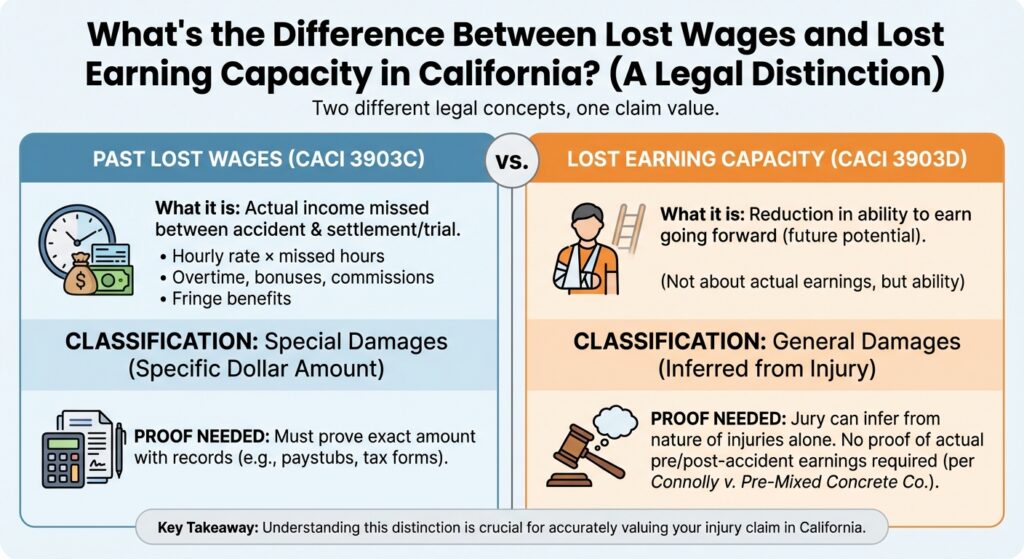

What’s the Difference Between Lost Wages and Lost Earning Capacity in California?

People use these terms interchangeably, but they’re actually two very different legal concepts, and understanding the difference can significantly change what your claim is worth.

Past lost wages (covered under CACI jury instruction 3903C) are straightforward. It’s the income you actually lost between the accident date and the date of your settlement or trial. Your hourly rate times the hours you missed, plus overtime, bonuses, commissions, and fringe benefits. These are special damages, meaning you have to prove the specific dollar amount.

Lost earning capacity (CACI 3903D) is something different entirely. It’s not about what you actually earned. It’s about the reduction in your ability to earn going forward. And this distinction is huge for certain kinds of cases. The California Supreme Court held in Connolly v. Pre-Mixed Concrete Co. that lost earning capacity is general damages. Meaning a jury can infer it from the nature of your injuries alone, without proof of actual earnings or income before or after the accident.

Think about a 25-year-old construction worker who suffers a permanent back injury. Maybe he was only making $45,000 a year at the time of the accident. But his earning capacity over a 40-year career, factoring in promotions, raises, and skill development, could be worth millions. That’s the difference.

How Do Self-Employed Workers Prove Lost Income After a Car Accident?

The legal standard is proving your losses with a “reasonable degree of certainty.” Harder than for a W-2 employee? Sure. Impossible? Not even close. California courts have been awarding lost income to self-employed claimants for decades.

What Documentation Do Different Work Types Need?

Gig workers (Uber, Lyft, DoorDash): Pull your detailed earnings reports from the app dashboard, not just the summary. Grab your 1099-K forms and bank records. And do this immediately. Screenshot everything you can. Rideshare and delivery companies will sometimes suspend accounts after a reported accident, and once that happens, accessing your earnings data gets a lot harder.

Freelancers and consultants: Client contracts, invoices, 1099-NEC forms, bank deposits, cancelled or postponed engagements, and email correspondence documenting lost work are all fair game. If a client cancelled a $10,000 project because you couldn’t deliver on time, that cancelled contract is evidence.

Small business owners: Profit and loss statements, bank records, and replacement worker costs. If you had to hire someone to cover your duties while you recovered, those wages are part of your claim. This is where it gets interesting: under Webb v. Standard Oil, tax returns are privileged in California personal injury cases. You may not have to produce your full returns. You can use P&L statements, receipts, and bank records instead.

What If Your Tax Returns Show Low Income?

This scares a lot of self-employed people, but it shouldn’t. Business deductions reduce your taxable income, but they don’t reflect your actual earning capacity. A freelancer who grosses $120,000 but shows $45,000 in net income after legitimate deductions wasn’t earning $45,000. A forensic accountant can reconstruct your true earnings picture from gross revenue, bank deposits, and client records. Personal injury attorneys typically front expert costs on contingency, so you don’t pay anything upfront.

Are Lost Wages from a Car Accident Taxable in California?

This is the one that trips up the most people. And honestly, a lot of lawyer websites get it wrong, too.

Are Lost Wages Tax-Free in Physical Injury Claims?

Yes. All compensatory damages, including the lost wages portion, are excluded from gross income under IRC § 104(a)(2) when they’re received “on account of personal physical injuries.” IRS Revenue Ruling 85-97 says this explicitly. The Supreme Court confirmed it in Commissioner v. Schleier. California conforms to the federal treatment through Revenue and Taxation Code § 17131.

So if you were physically hurt in a car accident and your settlement includes $30,000 for lost wages, $50,000 for medical bills, and $20,000 for pain and suffering, you owe zero taxes on all of it. The only parts of a physical injury settlement that get taxed are punitive damages and prejudgment interest.

What About Claims Without Physical Injury?

Different story. If your claim is purely for emotional distress without physical injury, lost wages become fully taxable as ordinary income. The 1996 Small Business Job Protection Act drew this line. And physical manifestations of emotional distress, things like insomnia or anxiety attacks, don’t count as “physical injury” for tax purposes. The D.C. Circuit Court confirmed that in Murphy v. IRS.

This is why settlement language matters so much. How your damages are allocated in the settlement agreement can have real tax consequences. Work with your attorney and a tax professional to get the language right.

Talk to a California Lost Wages Attorney

California’s two-year statute of limitations and six-month government claim deadline mean time matters. The longer you wait, the harder it gets to document your losses and the more power the insurance company has over you.

If you’re missing work because of someone else’s negligence, contact DK Law for a free case review. We’ll explain your options, and you won’t pay anything unless we recover compensation for you.

DK All the way

From Your Case to Compensation, we take your case all the way.

Schedule a Free Consultation

Get Expert Legal Advice at Zero Cost.

At DK Law we’re with you – all the way.

Get a Free Consultation with our experts today!

No comments:

Post a Comment